Rates Are Rising! Refinance Now At Low Rates While You Can!

The Federal Reserve dramatically lowered interest rates as part of their policies to help the economy during the pandemic. As the impacts of covid lessen, the Fed must now get interest rates and the economy back on track to pre-pandemic levels. The news, including a recent article by CNBC, has been reporting that the Federal Reserve is going to raise interest rates all year and well into 2023.

The Federal Reserve has not announced exactly how many rate hikes it will implement this year, although Wall Street experts are predicting between 4-7 rate hikes throughout this year. These rate hikes will start after the March 15-16 Federal Open Market Committee meeting. The expectation is incremental increases throughout the year of 25 basis points, or 0.25 percentage points. There were rumors that the first rate increase would be 50 basis points, double the normal expectations, in order to counter inflation more quickly. The recent conflict in Ukraine has changed that thought, and now most experts are sticking with the original expectations of an increase of just 0.25 percentage points in March.

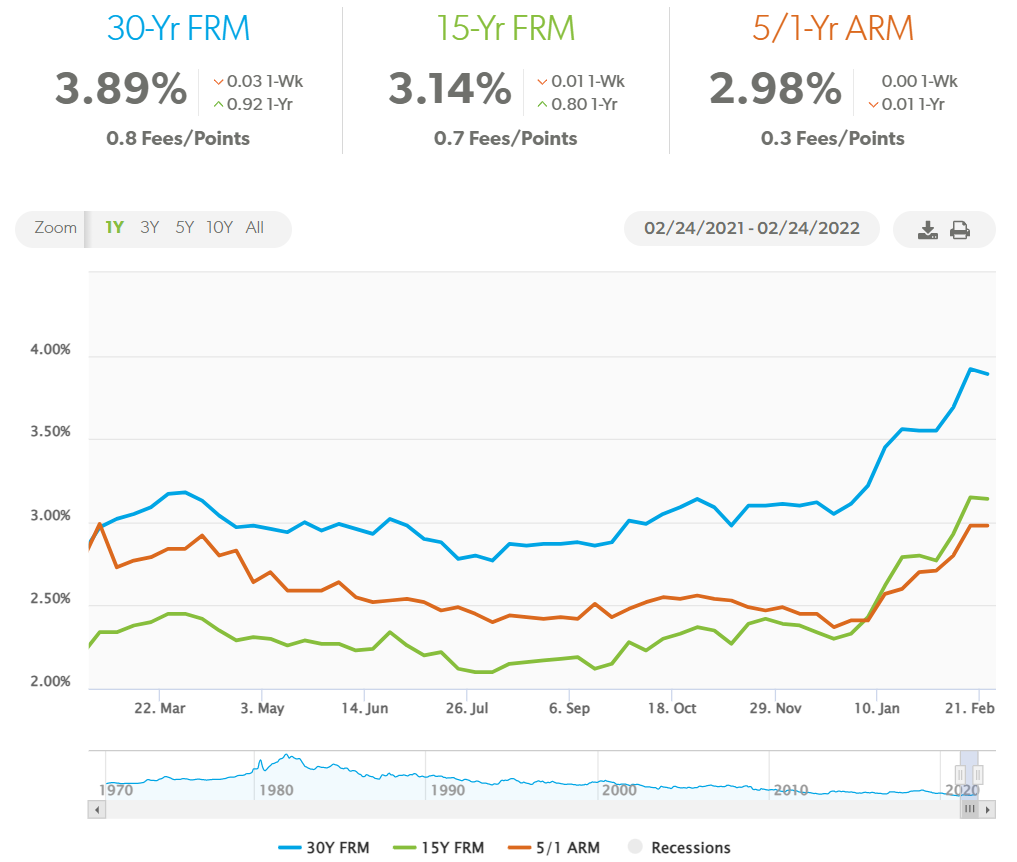

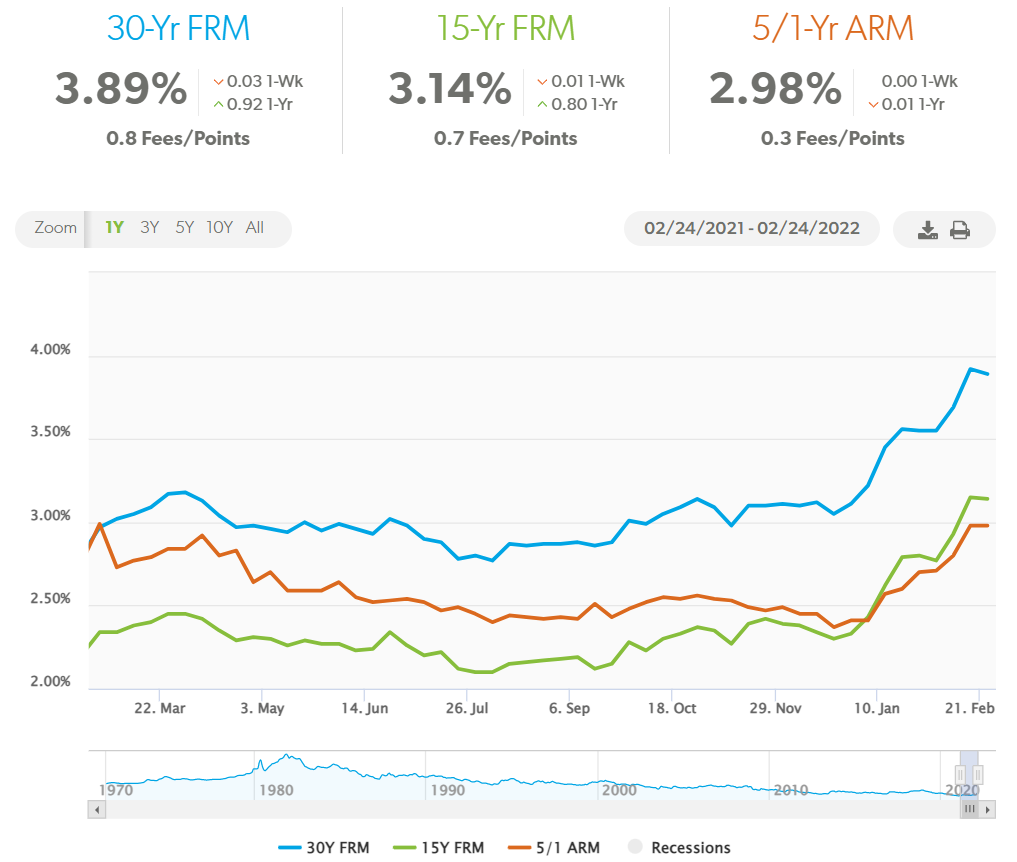

What does this mean for home buyers? This means mortgage rates will rise, which increases the amount of the required monthly mortgage payments, in the end this means paying more simply because of the higher rate. The pandemic brought interest rates down to historic lows, which has allowed people to take advantage of cheap home loans to buy their first homes, purchase rental properties to generate passive income, and refinance their old loans to take advantage of these extraordinarily low rates. The picture below is directly from the Freddie Mac website and clearly shows interest rates were low during the pandemic but are now going up, and quickly.

Recent Comments