Rising Mortgage Rates Lower the Amount People Can Borrow

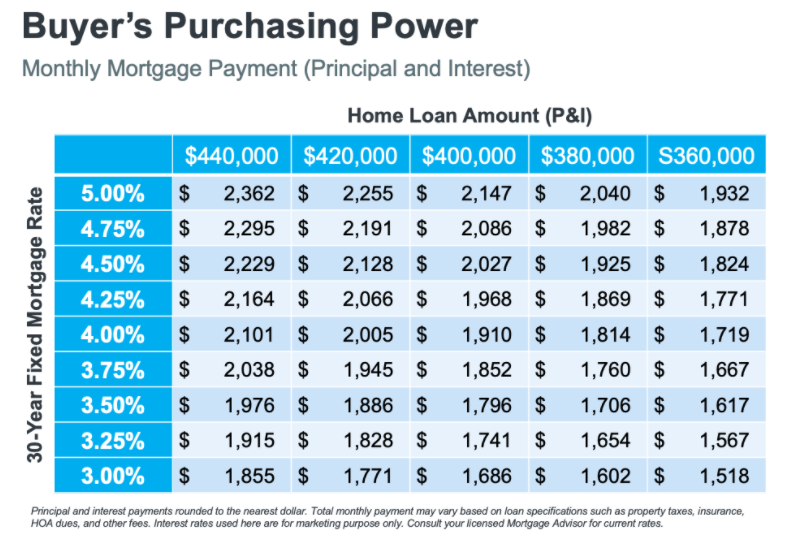

Did you know the average 30-year fixed-rate mortgage has risen from 3.22% at the start of the year to 3.55% as of last week?! Increasing rates impact how much a home purchaser can afford and this article from simplifyingthemarket.com does a great job explaining this in detail. The US Federal Reserve has announced multiple times that they are going to implement four rate increases this year, 2022. This means the sooner you get your home loan, you will most likely be getting a better rate as opposed to waiting.

ReNew Lending can help you quickly get the maximum value for a mortgage or refinance now before rates rise even higher. Contact a home loan specialist and get a free Quick Quote at https://reneweasymortgage.com/purchase-refinance-quick-quote/

#mortgage #mortgagerates #rates #refinance #homebuying #homeowner #conventionalloan #fhaloan #valoan #usdaloan #downpaymentassistance #renewlending

One Response

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.