Credit Score Basics

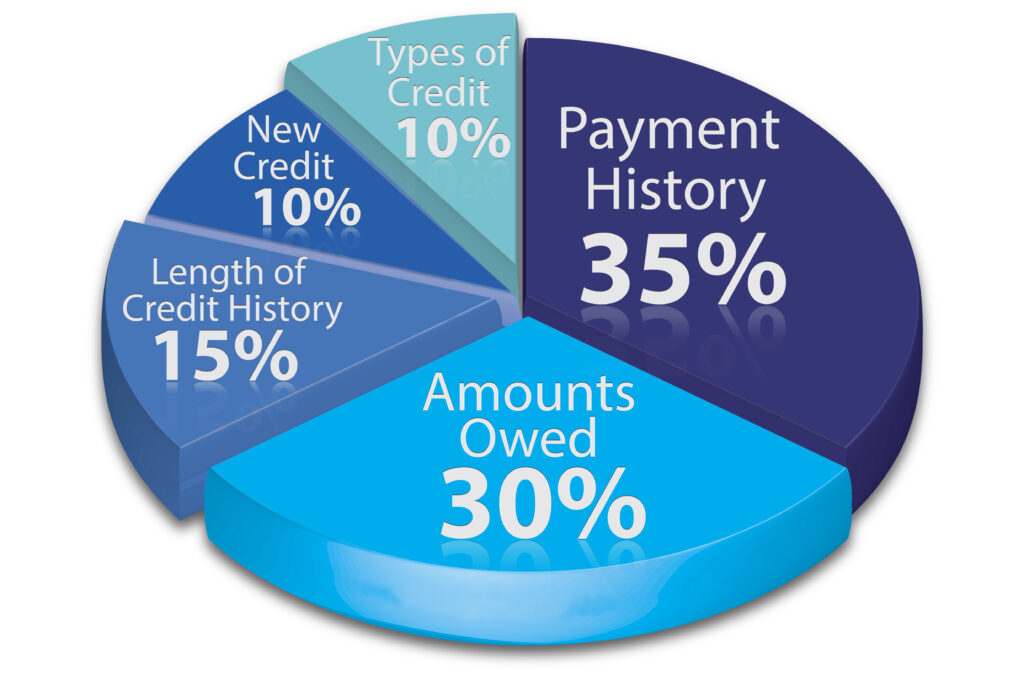

Credit scores are one of the most important factors that determine someone’s interest rate, but most people don’t know the basics of what goes into determining their credit score or how they can improve it. The five factors that affect credit scores along with the weight of their impact are displayed below. Some simple ways to improve your credit score are listed below that. Real estate/investing/social media guru Graham Stephan has a YouTube video discussing this topic in detail, but the main points that he talks about in his 15-minute video are summed up below in a quick one-minute read.

The five factors that impact credit scores are:

- On time payment history = 35%; late payments are on your history for 7 years, so at least make the minimum payments.

- Amounts owed = 30%; also measures utilization (how much credit is available versus how much you actually use). Higher utilization rates are usually bad but can be countered by having open accounts that are in good-standing and/or don’t have a balance or aren’t used often.

- Average age = 15%; the longer your accounts have been open and in good standing makes a positive impact.

- Types of credit = 10%; having a variety of credit such as credit cards, auto loans, home loans, etc. shows you can manage different finances and is good for your credit history.

- New Inquiries = 10%; number of hard inquiries shows risk to lenders.

How to raise your credit score:

Check credit score for free at credit karma or credit sesame anytime, or annualcreditreport.com once per year.

When checking your credit score, see what needs to be improved.

- Not enough credit: start building your credit history.

- Late payments

- Collections

- High balances or maxed out credit lines: shows risk, pay these down.

- Foreclosures or bankruptcies: you should know about these but they could potentially be a result of identity theft if you didn’t know about them.

To build credit history, you could become an authorized card user and “credit piggyback” off your close friend or family member that has good credit history. Obviously, that person needs to be comfortable with having you as an authorized user and make sure they have good credit, otherwise this won’t help you.

Credit utilization should ideally be below 10%. Opening a new credit card or increasing your credit limit on existing cards/accounts can lower the credit utilization percentage.

Experian boost is a newer way to raise your credit score by linking it to your phone and utility payments. This way paying your monthly phone and utility bills on-time will have a positive impact on your credit score.

Remove late payments: pay them off as soon as possible because the length of time payments are late matters. A 90-day late payment is worse than a 30-day late payment.

Try to negotiate debt amounts whenever possible, especially if it is in collections. Try to make payment arrangements if possible.

Dispute any inaccuracies.

Don’t close old accounts because having old accounts can positively impact your credit history.

Recent Comments